Understanding Japanese Candlestick Patterns

Posted by

Bigtrends on June 25, 2015 7:35 AM

Understanding Japanese Candlestick Patterns

Inside Japanese Candlestick Trading Patterns, History & Basics

by

optionalpha.com and

stockcharts.com

Japanese candlestick patterns have been around for centuries. Originally they were used by merchants to help them predict and profit from rice trading. You could say that they have really passed the test of time and are a "seasoned" tool for any financial market. If they weren't somewhat reliable then they would have faded away many years ago - but they are still being used all over the world even today.

History is not a favorite pastime for some traders. Most traders don't care what happened in the past, they only focus on where the market is going now. For me, I'm an avid student of the markets. Its useful to read a lot of books about early trading in the 30's and 40's as well as some of the more "modern" theories of technical analysis and portfolio management. This quick history of Candlestick Patterns hopefully will help shed some light on how to really use them to profit.

18th Century Rice Trading

While there are accounts of candlesticks being used as far back as the 17th century, the first detailed documentation of candlestick patterns can be traced back to an 18th century Japanese businessman named Munehisa Homma. Munehisa used candlesticks to chart and track rice contracts.

Everyone at the time was tracking rice contracts, but what he did was take an emotional approach to the market - analyzing fear, greed, and the herd mentality. He found a way to accurately observe the behavior of the masses and manipulate them to his advantage.

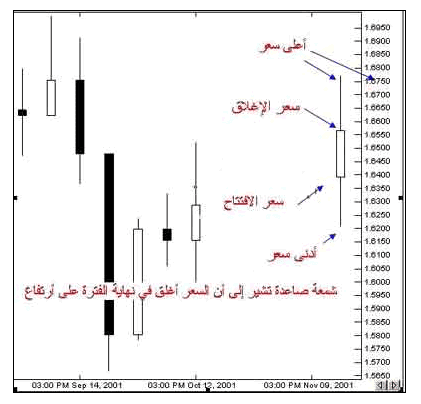

He tracked the opening and closing price along with the high and low of the day and placed them on a chart. This graphic representation was a series of columns that looked like candlesticks, hence the name.

He took an extremely chaotic market and brought some order and insight to why prices did what they did. The patterns that repeated themselves over and over again became his bedrock for future price moves. Homma made huge contributions to early candlestick charting.

There are some reports and sources that say he would consistently make dozens of profitable trades. Rumors are that he gained the equivalent of over $10 billion in today's dollars. He could have very well been the most successful trader in all of history...

Where Did The Crazy Names Come From?

Remember, we are still in 18th century Japan here. Munehisa needed a way to link the chart patterns to some visual concept - the tug of war between buyers and sellers in the market. With this, he labeled the names of specific candlestick patterns from mostly military concepts.

Today some of these patterns have kept their Japanese names such as the Doji Star, Harami, and Tasuki. Others have been translated into an English equivalent like the Abandoned Baby or Hanging Man. Either way, the patterns are still the same today as they were back then and just as powerful for your trading.

History

While this early version of technical analysis was different from the US version initiated by Charles Dow around 1900, many of the guiding principles were very similar:

* The "what" (price action) is more important than the "why" (news, earnings, and so on).

* All known information is reflected in the price.

* Buyers and sellers move markets based on expectations and emotions (fear and greed).

* Markets fluctuate.

* The actual price may not reflect the underlying value.

Formation

In order to create a candlestick chart, you must have a data set that contains open, high, low and close values for each time period you want to display. The hollow or filled portion of the candlestick is called "the body" (also referred to as "the real body"). The long thin lines above and below the body represent the high/low range and are called "shadows" (also referred to as "wicks" and "tails"). The high is marked by the top of the upper shadow and the low by the bottom of the lower shadow. If the stock closes higher than its opening price, a hollow candlestick is drawn with the bottom of the body representing the opening price and the top of the body representing the closing price. If the stock closes lower than its opening price, a filled candlestick is drawn with the top of the body representing the opening price and the bottom of the body representing the closing price.

Compared to traditional bar charts, many traders consider candlestick charts more visually appealing and easier to interpret. Each candlestick provides an easy-to-decipher picture of price action. Immediately a trader can compare the relationship between the open and close as well as the high and low. The relationship between the open and close is considered vital information and forms the essence of candlesticks. Hollow candlesticks, where the close is greater than the open, indicate buying pressure. Filled candlesticks, where the close is less than the open, indicate selling pressure.

Long Versus Short Bodies

Generally speaking, the longer the body is, the more intense the buying or selling pressure. Conversely, short candlesticks indicate little price movement and represent consolidation.

Long white candlesticks show strong buying pressure. The longer the white candlestick is, the further the close is above the open. This indicates that prices advanced significantly from open to close and buyers were aggressive. While long white candlesticks are generally bullish, much depends on their position within the broader technical picture. After extended declines, long white candlesticks can mark a potential turning point or support level. If buying gets too aggressive after a long advance, it can lead to excessive bullishness.

Long black candlesticks show strong selling pressure. The longer the black candlestick is, the further the close is below the open. This indicates that prices declined significantly from the open and sellers were aggressive. A fter a long advance, a long black candlestick can foreshadow a turning point or mark a future resistance level. After a long decline a long black candlestick can indicate panic or capitulation.

Even more potent long candlesticks are the Marubozu brothers, Black and White. Marubozu do not have upper or lower shadows and the high and low are represented by the open or close. A White Marubozu forms when the open equals the low and the close equals the high. This indicates that buyers controlled the price action from the first trade to the last trade. Black Marubozu form when the open equals the high and the close equals the low. This indicates that sellers controlled the price action from the first trade to the last trade.

Long Versus Short Shadows

The upper and lower shadows on candlesticks can provide valuable information about the trading session. Upper shadows represent the session high and lower shadows the session low. Candlesticks with short shadows indicate that most of the trading action was confined near the open and close. Candlesticks with long shadows show that prices extended well past the open and close.

Candlesticks with a long upper shadow and short lower shadow indicate that buyers dominated during the session, and bid prices higher. However, sellers later forced prices down from their highs, and the weak close created a long upper shadow. Conversely, candlesticks with long lower shadows and short upper shadows indicate that sellers dominated during the session and drove prices lower. However, buyers later resurfaced to bid prices higher by the end of the session and the strong close created a long lower shadow.

Candlesticks with a long upper shadow, long lower shadow and small real body are called spinning tops. One long shadow represents a reversal of sorts; spinning tops represent indecision. The small real body (whether hollow or filled) shows little movement from open to close, and the shadows indicate that both bulls and bears were active during the session. Even though the session opened and closed with little change, prices moved significantly higher and lower in the meantime. Neither buyers nor sellers could gain the upper hand and the result was a standoff. After a long advance or long white candlestick, a spinning top indicates weakness among the bulls and a potential change or interruption in trend. After a long decline or long black candlestick, a spinning top indicates weakness among the bears and a potential change or interruption in trend.

Doji

Doji are important candlesticks that provide information on their own and as components of in a number of important patterns. Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. Alone, doji are neutral patterns. Any bullish or bearish bias is based on preceding price action and future confirmation. The word "Doji" refers to both the singular and plural form.

Ideally, but not necessarily, the open and close should be equal. While a doji with an equal open and close would be considered more robust, it is more important to capture the essence of the candlestick. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level. The result is a standoff. Neither bulls nor bears were able to gain control and a turning point could be developing.

Different securities have different criteria for determining the robustness of a doji. A $20 stock could form a doji with a 1/8 point difference between open and close, while a $200 stock might form one with a 1 1/4 point difference. Determining the robustness of the doji will depend on the price, recent volatility, and previous candlesticks. Relative to previous candlesticks, the doji should have a very small body that appears as a thin line. Steven Nison notes that a doji that forms among other candlesticks with small real bodies would not be considered important. However, a doji that forms among candlesticks with long real bodies would be deemed significant.

Doji and Trend

The relevance of a doji depends on the preceding trend or preceding candlesticks. After an advance, or long white candlestick, a doji signals that the buying pressure is starting to weaken. After a decline, or long black candlestick, a doji signals that selling pressure is starting to diminish. Doji indicate that the forces of supply and demand are becoming more evenly matched and a change in trend may be near. Doji alone are not enough to mark a reversal and further confirmation may be warranted.

After an advance or long white candlestick, a doji signals that buying pressure may be diminishing and the uptrend could be nearing an end. Whereas a security can decline simply from a lack of buyers, continued buying pressure is required to sustain an uptrend. Therefore, a doji may be more significant after an uptrend or long white candlestick. Even after the doji forms, further downside is required for bearish confirmation. This may come as a gap down, long black candlestick, or decline below the long white candlestick's open. After a long white candlestick and doji, traders should be on the alert for a potential evening doji star.

After a decline or long black candlestick, a doji indicates that selling pressure may be diminishing and the downtrend could be nearing an end. Even though the bears are starting to lose control of the decline, further strength is required to confirm any reversal. Bullish confirmation could come from a gap up, long white candlestick or advance above the long black candlestick's open. After a long black candlestick and doji, traders should be on the alert for a potential morning doji star.

Long-Legged Doji

Long-legged doji have long upper and lower shadows that are almost equal in length. These doji reflect a great amount of indecision in the market. Long-legged doji indicate that prices traded well above and below the session's opening level, but closed virtually even with the open . After a whole lot of yelling and screaming, the end result showed little change from the initial open.