5.2 Using Multiple Time Frame Analysis in Forex Trading

Before we talk about multiple time-frame analysis or keeping an eye of charts of different time frames while trading on one specific time-frame chart, let's talk about a real short story which caused such big waves which could be compared to a financial tsunami in the Forex market.

It was January 15, 2015 when SNB (Swiss National Bank) took a decision to remove the 3 year old cap from the exchange rate of EUR/CHH to be up to 1.2000. The decision came without any prior warning and wiped off tens of billions dollars from the balance sheets of companies.

Swiss Franc appreciated close to 30% against euro almost instantly. Same was the story against other currency majors. Major Swiss exporters were hit and some of the Forex brokers had to close their shops or had to take some major hits.

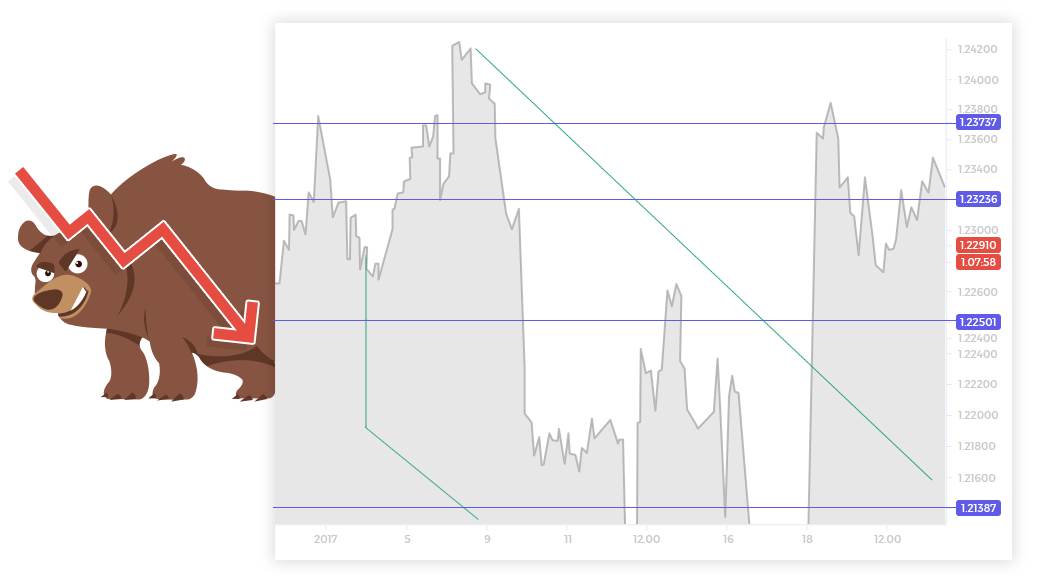

Let's check the daily chart of USD/CHF before we move ahead.

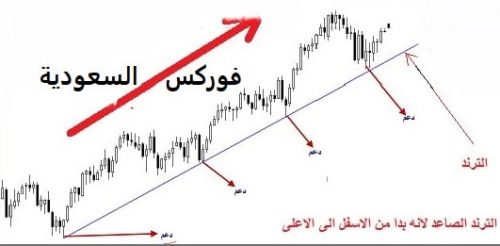

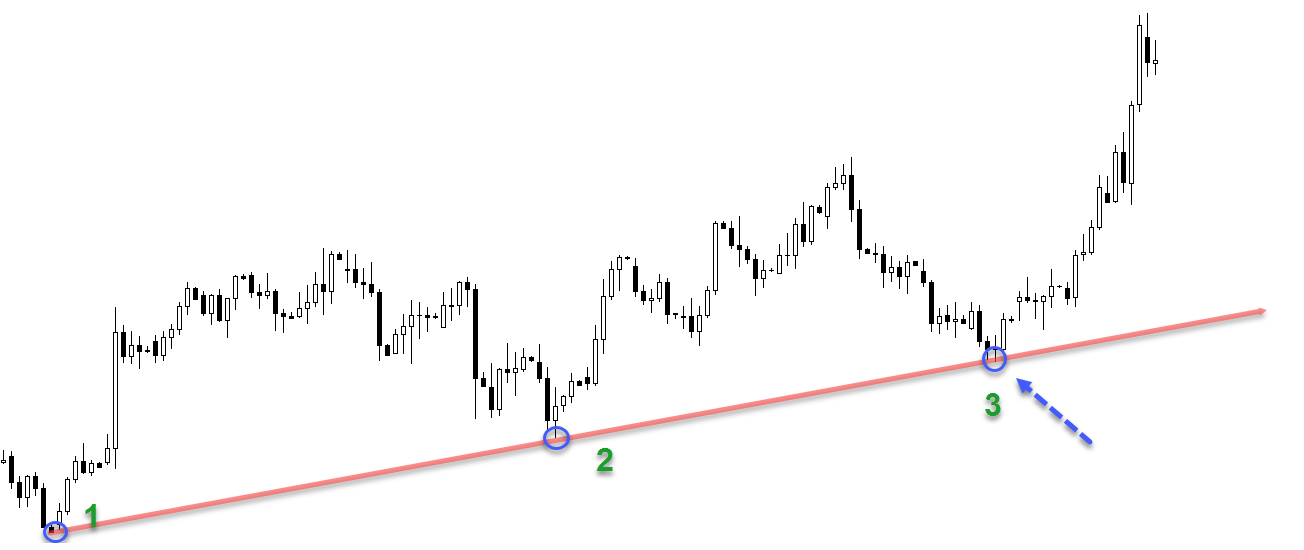

Observations by any trader looking at the daily chart, just before the shit hit the fan, were:

- The prices were rising in an ascending channel, indicating bullish sentiments.

- There was an effort of breakout which again went into the favor of the bullish sentiments.

- The breakout did not sustain but the short fall found support well ahead of the support line hence favoring the possibilities of another upward break.

All the above observation might make a trader to go for a long position, but maybe not, if the trader was keeping an eye on the monthly chart as well.

Let's have a look on that:

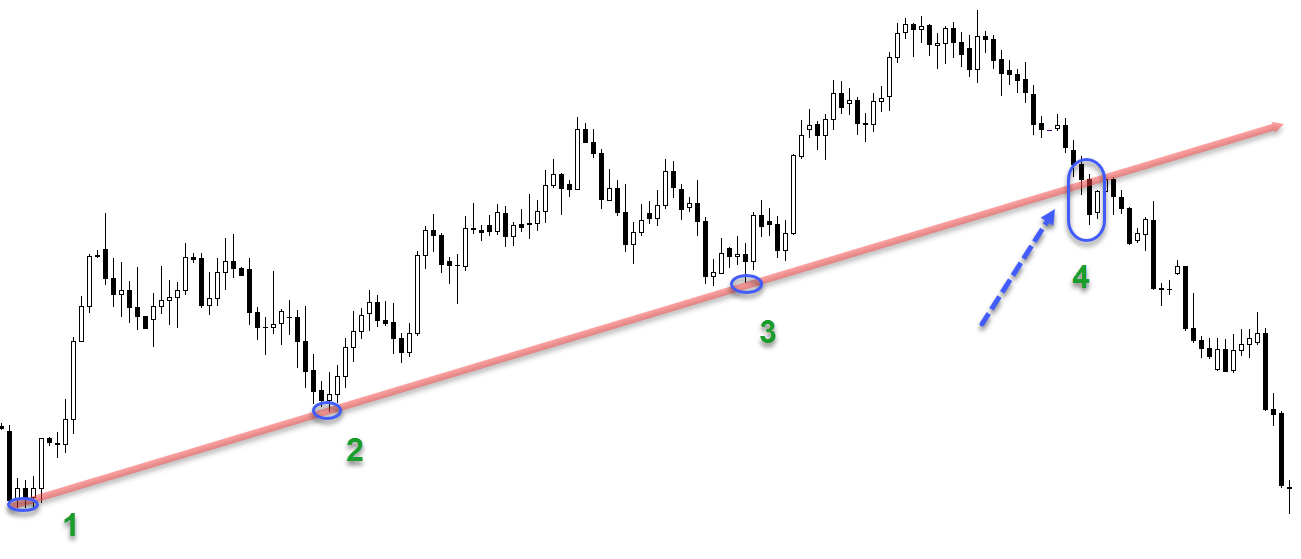

At the same time

when the daily chart was indicating the possible "buy", a look on the monthly chart could have whispered in your ears that you might be better off without a short position because the price was in the zone of a previous support which had started acting as resistance.

And then what? Traders, who might be away from the action but witnessed the great-bad fall, might have thought of getting into the short side of a trade to ride the train bound south. However, the monthly chart indicated that though the price-action tried to break the support but could not manage to sustain and here is what really happened:

This is the art of looking at a currency pair and its price through different charts, each representing a different time periodicity.

Got you cross-eyed there in confusion? No sweat, just look at these charts of the EUR/USD shown for 5-minute, 4 hours, daily and weekly intervals:

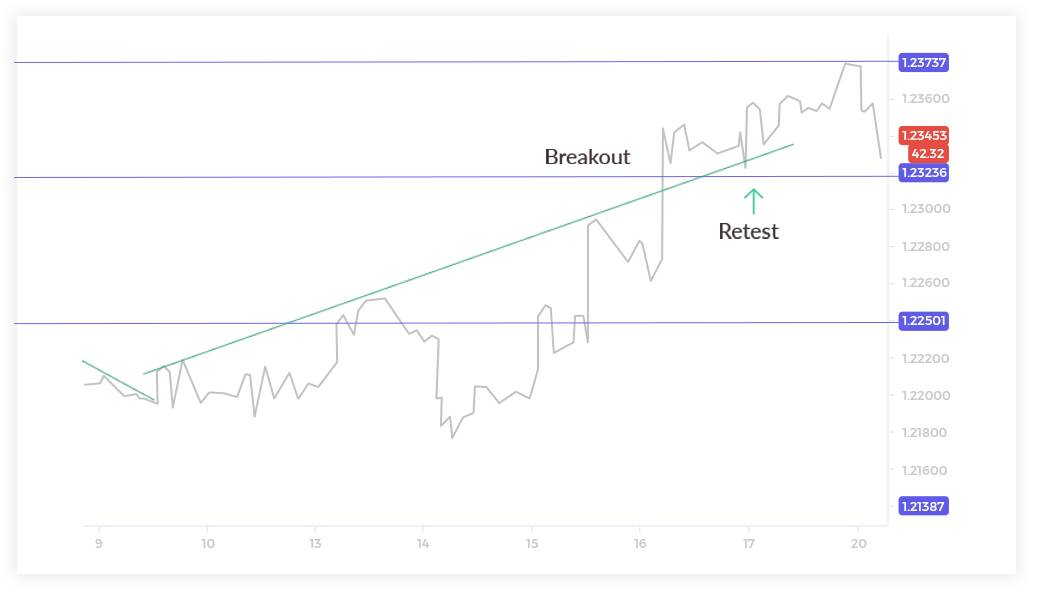

The 5-minute chart as show above came up with a breakout from the

rectangle pattern and we grab this opportunity to enter a short trade, without considering what has been happening on other time frames.

Well, it's not that the trade would always go against us but it is better to know the overall situation. Correct? So let's see the 4-hourly Forex chart:

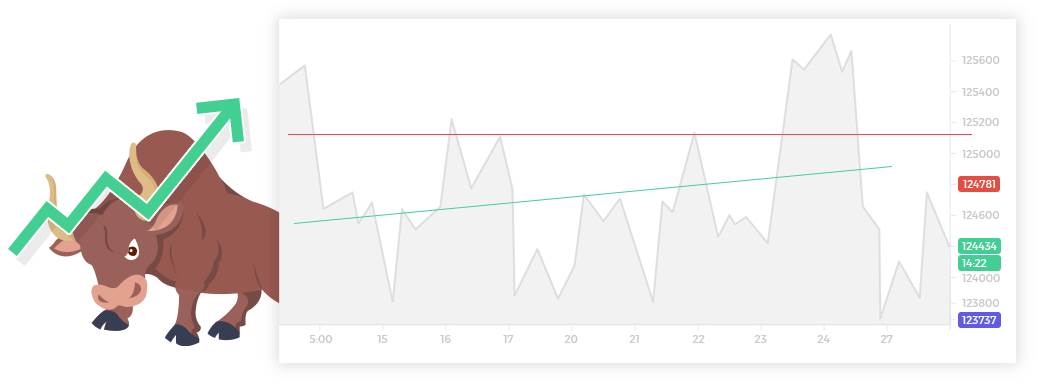

The large red bar of the 4-hours on the right hand side covered the entire fall from point A to B witnessed on the 5-minute chart. The breakout from the rectangle pattern took place just near the previous resistance zone which might very well turn into support; and it seems as it did. Going for a short position might have burned a hole in the pocket.

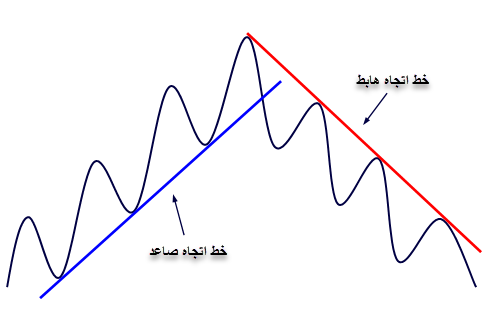

Let’s also look what the daily chart says during the same time. Here we go:

The daily chart supports the view of the 4-hourly chart. The price-action has been in a

descending triangle pattern and seems to be moving up after finding support near the support line.

Please also note that this support zone is a critical one as it proved to be a

support first, which then turned into resistance zone and then again turned into a support zone. We would be very careful before thinking about going short near such support.

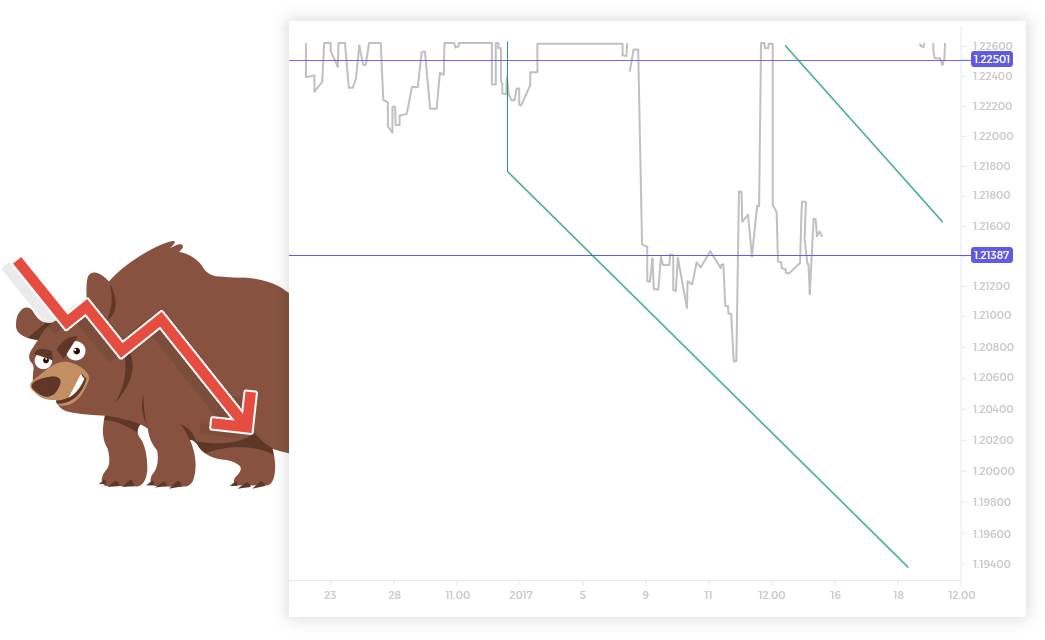

Why to stop here? Let’s go ahead to have a look on the weekly chart:

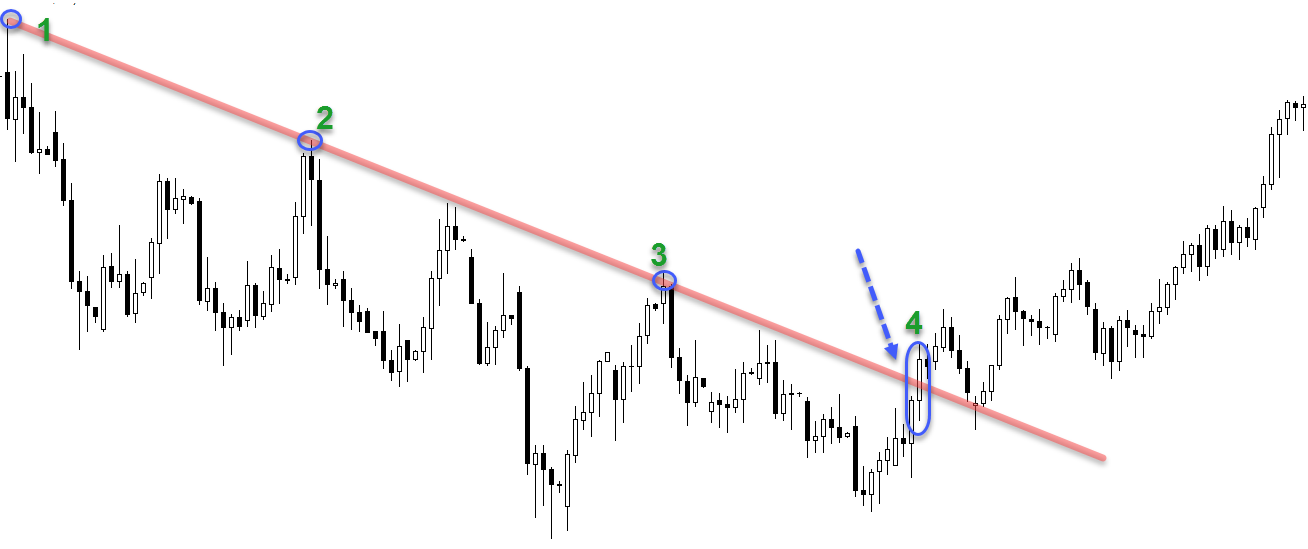

Weekly chart is showing the price action in an

ascending triangle pattern; completely opposite to the daily chart. It is also indicating the scope of some further decline.

This puts traders in a quandary. Which is the time frame they should trade?

The most suitable time frame varies from trader to trader and depends upon his trading personality. Moreover, even though a trader may be having a preference for a particular time frame, he can enhance his trading skills considerably by looking at the other time frames of the pair. We will cover about selecting the time-frame to trade with, in the next lesson. The purpose of this lesson was to see why we should keep our eyes on various time-frames. The best trade could be when the shorter time frame chart conforms to longer-term chart.

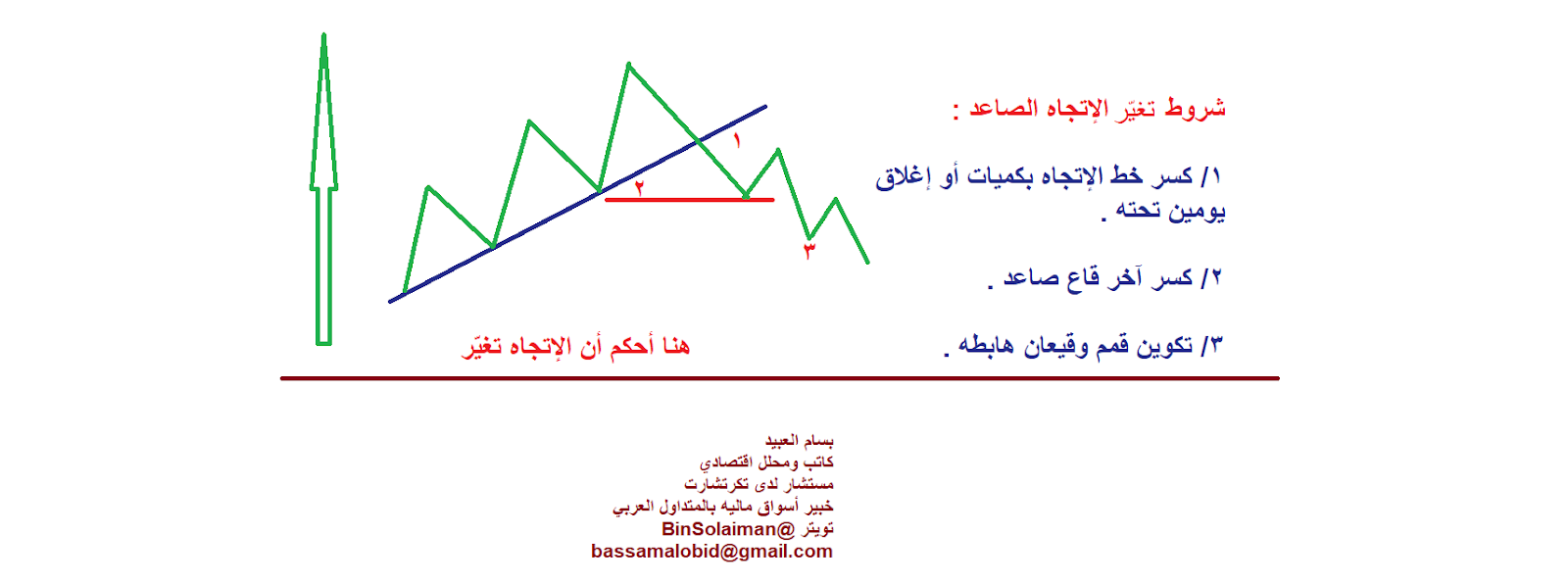

As a summary the Forex charts of different time frames can be used in the following ways:

Usage of Longer-Term Charts

- To know the overall trend situation.

- To see if there is any immediate opposite signal to the position we are planning.

- To plan the stop-loss and profit targets. This is important as the longer time-frame chart may be indicating that the trend is expected to continue while the short-term chart may make a market noise by falsely forcing us to close the position early.

Usage of Short Time-Frame Charts

- To plan the entry points for the trades to maximize profits.

- In certain cases, where a correction is expected to be more than the risk appetite, to plan the exits as well.

Three words of advice here

"Not Too Many". Yes do not try to confuse yourself with too many time frames. Use two or maximum 3 time frames. If you are trading with an hourly chart then you may like to keep an eye on the daily and maybe a weekly chart as well. In case you are trading with a 10 minutes of 15 minutes chart then you may like to consult hourly and 4-hourly charts. Too many time-frames may end up confusing you instead of enlightening.

Secomd advice would be to

get the broader picture first by checking the longer-time frame charts first before going to short-term charts and not the vice-versa.

And when we are on it, the third advice will be covered in the next chapter that it is advisable

not to trade on very short-term charts. You must have seen that rarely we have used charts below 1-hour time frames but a lot of 4-hourly, daily and weekly charts, not only in this lesson but throughout.

http://www.forexabode.com/forex-sch...trategies/multiple-time-frame-chart-analysis/